The Only Guide to Stonewell Bookkeeping

Wiki Article

The Greatest Guide To Stonewell Bookkeeping

Table of Contents10 Easy Facts About Stonewell Bookkeeping ShownGetting The Stonewell Bookkeeping To WorkStonewell Bookkeeping Things To Know Before You Get ThisThe 20-Second Trick For Stonewell BookkeepingThe 8-Minute Rule for Stonewell Bookkeeping

Here, we answer the inquiry, how does bookkeeping assist a business? The true state of a firm's funds and cash circulation is always in flux. In a feeling, audit books stand for a photo in time, but just if they are upgraded frequently. If a company is taking in little bit, a proprietor needs to take action to boost income.

It can likewise deal with whether to raise its own compensation from customers or customers. However, none of these final thoughts are made in a vacuum as valid numeric information need to copyright the financial choices of every little company. Such data is assembled with accounting. Without an intimate knowledge of the characteristics of your capital, every slow-paying client, and quick-invoicing financial institution, becomes an occasion for anxiety, and it can be a laborious and dull task.

Still, with correct cash flow administration, when your publications and ledgers depend on date and integrated, there are much fewer enigma over which to worry. You understand the funds that are available and where they fail. The news is not constantly excellent, but a minimum of you know it.

Some Known Details About Stonewell Bookkeeping

The maze of deductions, credit ratings, exceptions, schedules, and, certainly, penalties, is sufficient to just surrender to the internal revenue service, without a body of efficient paperwork to sustain your insurance claims. This is why a dedicated bookkeeper is very useful to a local business and is worth his or her weight in gold.

Your company return makes claims and depictions and the audit focuses on verifying them (https://giphy.com/channel/hirestonewell). Good accounting is everything about linking the dots in between those representations and truth (small business bookkeeping services). When auditors can comply with the information on a journal to invoices, financial institution declarations, and pay stubs, among others records, they rapidly learn of the proficiency and integrity of business organization

The 9-Second Trick For Stonewell Bookkeeping

Similarly, careless bookkeeping adds to tension and stress and anxiety, it likewise blinds entrepreneur's to the possible they can understand in the long run. Without the details to see where you are, you are hard-pressed to set a location. Just with reasonable, in-depth, and factual information can a company owner or management team plot a program for future success.Local business owner understand best whether an accountant, accounting professional, or both, is the appropriate service. Both make crucial payments to a company, though they are not the exact same occupation. Whereas an accountant can collect and organize the information needed to support tax preparation, an accountant is much better matched to prepare the return itself and really examine the earnings statement.

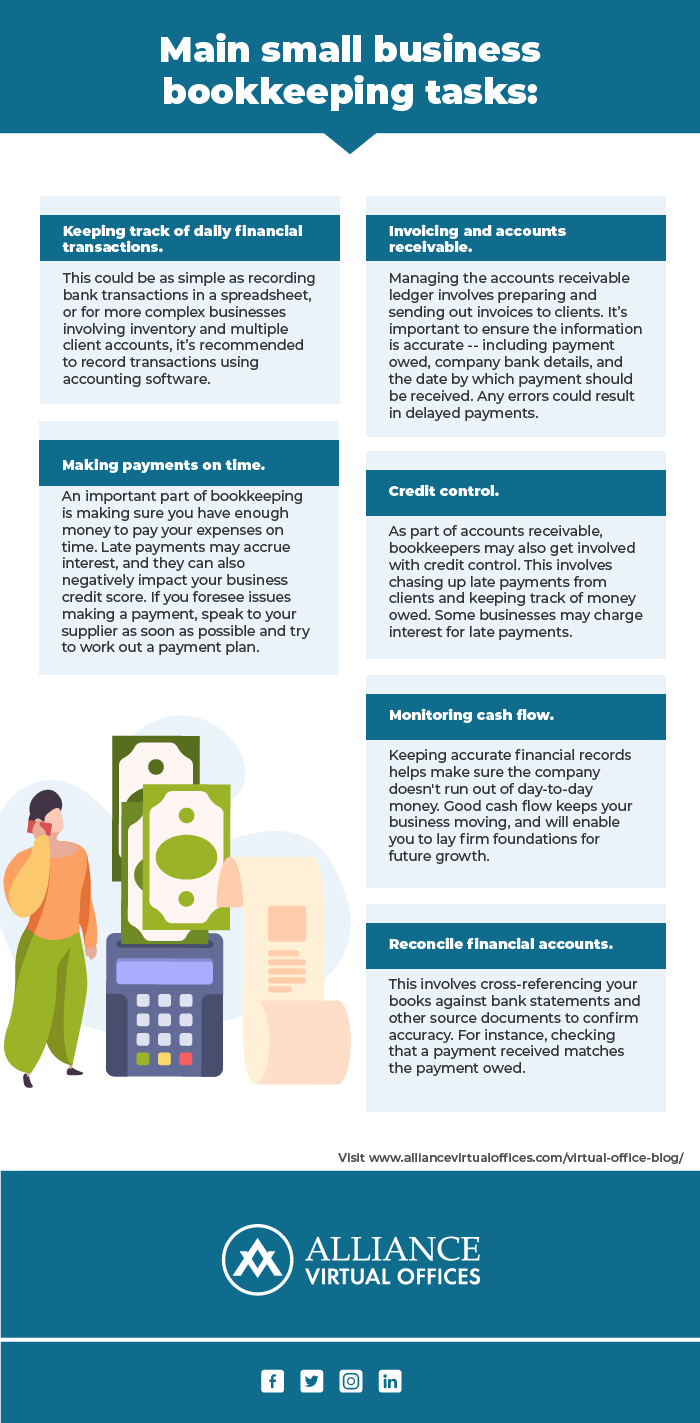

This write-up will look into the, including the and just how it can benefit your business. We'll also cover just how to begin with bookkeeping for an audio economic footing. Accounting includes recording and arranging financial purchases, including sales, acquisitions, settlements, and receipts. It is the procedure of keeping clear and concise documents so that all economic information is quickly available when needed.

This write-up will look into the, including the and just how it can benefit your business. We'll also cover just how to begin with bookkeeping for an audio economic footing. Accounting includes recording and arranging financial purchases, including sales, acquisitions, settlements, and receipts. It is the procedure of keeping clear and concise documents so that all economic information is quickly available when needed.By routinely updating financial documents, bookkeeping assists services. Having all the financial information conveniently obtainable maintains the tax obligation authorities completely satisfied and avoids any last-minute migraine during tax obligation filings. Normal bookkeeping makes certain well-kept and orderly records - https://link.pblc.app/pub/52f10ac8cc5e3c. This assists in easily r and saves services from the anxiety of looking for documents during deadlines (best franchises to own).

visit site

The Ultimate Guide To Stonewell Bookkeeping

They also desire to know what capacity the company has. These aspects can be conveniently handled with accounting.Thus, accounting helps to stay clear of the problems associated with reporting to investors. By keeping a close eye on economic records, services can set practical objectives and track their progression. This, in turn, promotes much better decision-making and faster company growth. Federal government laws usually require businesses to maintain monetary documents. Routine bookkeeping makes certain that services stay certified and avoid any type of penalties or lawful problems.

Single-entry accounting is straightforward and functions ideal for little businesses with few deals. It includes. This approach can be contrasted to preserving a straightforward checkbook. However, it does not track possessions and responsibilities, making it less thorough contrasted to double-entry accounting. Double-entry accounting, on the other hand, is more advanced and is usually taken into consideration the.

Some Ideas on Stonewell Bookkeeping You Need To Know

This could be daily, weekly, or monthly, relying on your service's size and the quantity of deals. Do not think twice to seek help from an accounting professional or accountant if you find handling your economic records challenging. If you are looking for a complimentary walkthrough with the Accounting Solution by KPI, call us today.Report this wiki page